Student Loan General Information

Confirming enrolment and receiving your student loan

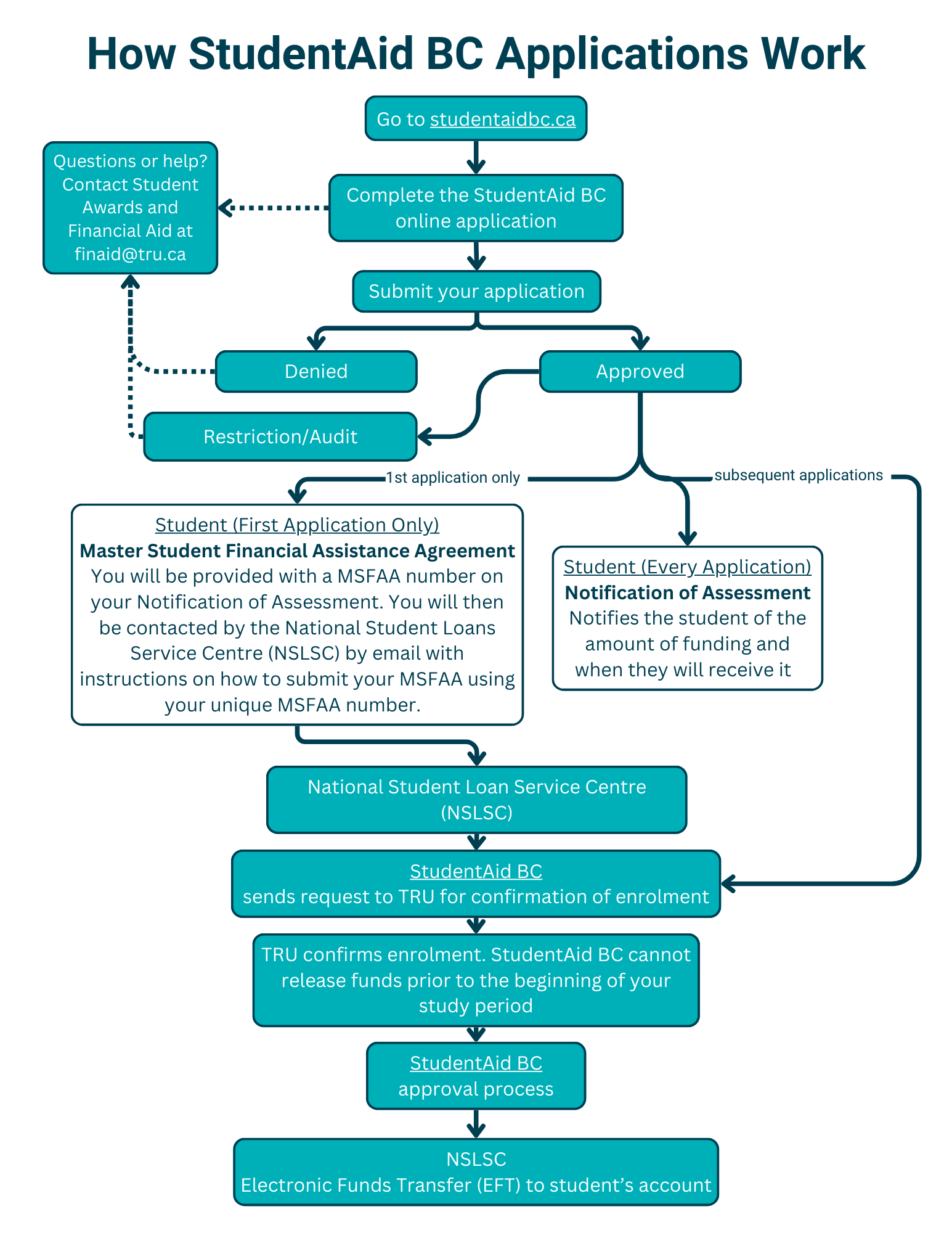

The National Student Loans Service Centre (NSLSC) administers your loan on behalf of the Government of Canada and the provincial governments. Once your application has been assessed, notifications will be sent from StudentAid BC or your home province to your email account to check the status of your loan.

Master Student Financial Assistance Agreement (MSFAA)

MSFAAs are issued to new full-time borrowers. The National Student Loan Service Centre (NSLSC) will send communication with a link to create a NSLSC account and complete your MSFAA.

Please follow this link to the National Student Loan Service Centre (NSLSC) for more information.

Once your loan agreement has been processed, the government will confirm your enrolment electronically with the university.

Student Aid BC loan application process

StudentAid BC funding and split enrolment

If you are taking credit courses from more than one institution at the same time, this is referred to as split enrolment. You may be considered for StudentAid BC funding only if the course(s)

- is offered with the same start and end dates as those at your home school;

- is being taken from an officially designated school;

- is an essential element of your program;

- will count for credit towards your certificate, diploma or degree at your home school;

- is not offered by the home school, or is oversubscribed (full); and

- the Financial Aid Advisor at your home school has approved your course(s) for split enrolment.

Withdrawals, technical and unofficial withdrawals and drop below 60 percent* withdrawal

*40% for students with recognized permanent disabilities, 80% for students receiving Quebec or Newfoundland loans.

If you intend to drop courses or to switch from credit to audit, it is advisable to check with the Student Awards & Financial Aid office to ensure it will not affect your student aid.

Important: University Prep courses do not count for student loan purposes - only post-secondary credits count.

Know what makes up 60 percent of a full program load. It is 60 percent of the credits, not the courses. For academic undergraduate programs, this is a minimum of nine credits completed per four-month period.

Make sure you hand in your assignments, attend classes and seminars and write all quizzes and exams; otherwise you may be considered to have technically withdrawn from the course, which could drop you below the required 60 percent program load.

All withdrawals (regular and extenuating circumstances) which drop a student below the required 60 percent program load result in reassessment and generally disentitlement to funds. Future student aid could be affected by an overaward (see below).

Scholastic standing can be appealed when a student is otherwise on track to successfully complete their program and one of the following criteria has impacted their ability to study:

- medical illness or injury

- family emergency (e.g. death, injury, etc.) or natural disaster; or

- other extraordinary circumstances.

Important: Do not rely on anyone other than Student Awards & Financial Aid staff any time you have questions concerning your loan. Student aid programs and policies change frequently and people who do not work directly with the programs are likely to have outdated information.

Academic advice may conflict with student financial aid requirements. It is your responsibility to ensure your financial aid is not affected by academic decisions you may make or are advised to make.

Overawards

When a student receives more assistance than they are eligible to receive, an overaward is created. This may be caused by a reassessment on an application due to new information received, an audit being conducted by StudentAid BC, a withdrawal from full-time studies or other reasons. In most circumstances, students will have a loan overaward deducted from any future loan entitlement.

Payment-free status

Students eligible for payment-free status are not required to make payment or principal payments on their outstanding Canada-B.C. integrated student loan.

In order to be eligible, students must submit a payment-free application online, and be enrolled full time in a program of study which has been designated eligible for StudentAid BC funding. Most academic programs require a separate Payment-Free application each semester, however you can submit an application for both fall and winter semesters at the same time. Students who are in payment-free status are in a "funded term" whether they have new loans or not; therefore, withdrawals and unsuccessful terms during this time may affect their eligibility for further assistance

Please note that normal processing time for payment-free requests is 2-3 days. In addition, files may take two additional days to pass from StudentAid BC to NSLSC. Therefore please submit your online application at least two weeks prior to when you will enter repayment, but preferably far before that.

Planning for repayment

Do you understand what happens when your student loans go into repayment? Do you want to know what your repayment options are? We recommend signing up for a National Student Loan Service Centre account or contact Student Awards & Financial Aid for questions.

Repayment assistance plan

The Governments of Canada and B.C. offer the Repayment Assistance Plan (RAP). The RAP helps eligible borrowers who are having financial difficulty repaying their student loans by allowing them to pay back what they can reasonably afford. Borrowers must reapply for subsequent periods of RAP. For further information visit the Government of Canada website.

website.

Repayment Assistance Plan for Borrowers with Permanent Disability

The Governments of Canada and B.C. offer the Repayment Assistance Plan for Borrowers with a Permanent Disability (RAP-PD). The RAP-PD helps eligible borrowers with permanent disabilities that are having difficulty repaying their student loans by allowing them to pay back what they can reasonably afford.

TRU emergency bridging loan

Emergency Loans are intended to assist students who are experiencing unforeseen financial difficulty and have no available options for securing short term funds. Student must be in receipt of government student financial assistance, have a positive history of tuition payment at TRU, be able to demonstrate reasonable financial need (unreasonable financial need is greater than $5,000 with no other resources) and may have to suspend study due to financial need. Typically these loans are reserved for students whose government student aid has been delayed to assist in meeting short term living costs.

To start an application for emergency funding, email studentawards@tru.ca with a brief description of your situation and needs and we will reply promptly.

Indigenous emergency aid fund

Funding has been provided by the Province of British Columbia for emergency relief funds to Indigenous learners attending British Columbia public post-secondary institutions in order to have a positive impact on retention and completion.

Bursaries valued up to $900 per qualified individual are intended to assist students at any stage in their TRU program with specific unforeseen costs (e.g. replacement eyeglasses, emergency travel, etc). To apply please contact Indigenous Services

Fee deferrals

A fee deferral is an extension of the deadline to pay fees owing to Thompson Rivers University.

It is the student’s responsibility to ensure that all fees and deposits are paid in full by Fee Payment Deadlines established by Thompson Rivers University, or to obtain an approved fee deferral in advance of these deadlines. Payment in full must be made by fee payment deadlines to avoid de-registration from your courses due to unpaid fees.

Students who meet all of the following conditions will have their fees deferred automatically:

- Cannot pay the balance of their fees by the deadline dates and

- Who have been approved for government student loan funding or a TRU scholarship/award or an award from a donor outside of Thompson Rivers University whereby the funding is directly payable to Thompson Rivers University and

- The approved funding amount is greater than the total fees owing.

Students who do not meet the eligibility requirement listed above are not eligible to apply for a fee deferral.

Sponsorship recipients (e.g. Indigenous band funding) who do not meet the eligibility requirements listed above should contact the Thompson Rivers University Finance Division.

Student Awards & Financial Aid does not offer payment plans of any kind.

Study Abroad

Have you been accepted to Study Abroad by TRU World?

Will you be applying for a student loan?

If yes to both, please read our Study Abroad Fact Sheet.

Also visit the Study Abroad website for more information.

International students

Student Awards & Financial Aid does not offer access to loan programs for international students who do not fall into an eligible Canadian citizenship category. However, there may be loan options available to you in your home country. It’s worth checking with your government representative to find out if there are any options you can benefit from.